How To Day Trade With Less Than $25,000

Let’s go over why day trading is the worst method to invest in shares — and what you must concentrate on as an alternative. When I first began I did what most people do, or what we thought was, swing buying and selling. I was busy in school https://www.beaxy.com/ and work and didn’t have time to look tick by tick; my understanding basic and technical was pretty minimal. At the time I was consistently dropping with a small account. 5) Last, and never mentioned, is to have sufficient capital reserves to make use of.

Starting out with at least $500 offers you flexibility in how one can trade that an account with solely $one hundred in it does not have. Starting with $5,000 or more is even higher because it can assist you to produce an inexpensive quantity of income that may compensate you for the time you’re spending on trading. You can see how opening an account with only $one hundred severely limits how you Active Trading can commerce. Also, in case you are risking a really small greenback quantity on each trade, by extension you are going to be making solely small features when you guess appropriately. To make bigger features—and presumably derive an inexpensive quantity of income out of your trading activity—you will require more capital.

Benzinga’s #1 Breakout Stock Every Month

In a male-dominated business, the women who got here to trade typically actually wished to do it, and were critical about it. Many of the lads who attempt day trading are doing so with a “I will give it a shot…” attitude. Be severe and commit https://www.binance.com/ to the process–just as when you had been beginning another business. The agency didn’t provide plenty of strategy guidance. They left it as much as the dealer to resolve how they might commerce.

Can you day trade with 5000?

Trading Times Differ Both day trading and swing trading require time, but day trading typically takes up much more time. Day traders usually trade for at least two hours per day. If you can’t day trade during those hours, then choose swing trading as a better option.

Active merchants have the intent of solely holding trades for a brief period of time. Just ask anyone who bought shares in March 2009 — the Standard & Poor’s 500 index is up about 250% since then. A latest NerdWallet study reveals investing in the stock market can return hundreds of thousands more retirement dollars than putting cash in a standard Active Trading savings account or keeping it in money. The foreign exchange market is the biggest financial market in the world, with more than $5 trillion traded on average daily. Now, I’m not necessarily saying you need to put your whole money in an index fund and overlook about it.

The first commerce was a winner, the second a loser, the third a winner, the fourth a small profit, the fifth a small loss, and sixth and seventh have been each winners. The active trader, like all dealer, is simply making an attempt to make more than they lose on the trades they take, total. Since commissions and charges can add up rapidly when actively buying and selling, winnings must be sufficient to overcome these costs. Even amongst day merchants, it is unlikely that any two will commerce precisely the identical. The following chart shows how a value-action based mostly day dealer might trade a one-minute chart of the SPDR S&P 500 (SPY).

I nonetheless would be however I got married and my wife needed me to take a job with a more “consistent” income stream. The greatest %url% causes of profitable tradersk vs. losers virtually boiled right down to several factors.

You can take a look at extra Fool.com articles for sound evaluation of high quality companies. To illustrate this, contemplate an instance of a trader who enters and exits 30 trades in the average day.

How can I make $500 an hour?

Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity. Among all traders, profitable traders increase their trading more than unprofitable day traders.

In all my years I by no means touched Forex, small cap stocks, etc. I learned early on that I was finest using the every day wave on massive cap shares and getting out before the closing bell (you don’t have to pay any marking curiosity that method). Also, good your technique as finest you can by doing false paper trades alongside the way in which and measure your success price along the way.

The lifetime of a day trader may seem thrilling, however it is a life lived on the edge. In a method that is partially true, as unexpected occasions or buying and selling outcomes can happen on any given day. The actuality though is that almost all days are quite ordinary, nothing a lot thrilling occurs. Here’s what day trading is basically like, so you’ll be able to see for yourself whether it is right for you.

- Start with as little as $2,000 for foreign exchange swing buying and selling.

- It’s recommended futures merchants begin with a minimum of $2,500 (if trading a contract just like the E-mini), however that may range based mostly on threat tolerance and the contract(s) traded.

- Your income, in dollars, is tied to the amount you commerce with, despite the fact that smaller and bigger accounts can usually expect similar proportion returns on their trading capital every month.

- These are the minimums I would advocate swing buying and selling with.

- For instance, should you make 5% a month trading a $2000 account, your earnings is $100.

- For shares and options begin with a minimum of $10,000.

Not solely do you get to familiarize yourself with trading platforms and the way they work, however you also get to check varied trading strategies without shedding real cash. The hyperlink above has a listing of brokers that offer these play platforms. the way to day trade — it covers a lot of the day trading basics you need to know. But then, follow makes excellent — or as near it as you can get, as you’ll quickly study there isn’t a good in day trading, and even the pros lose cash typically. Not everyone who buys and sells shares is a inventory dealer, no less than in the nuanced language of investing terms.

Traders with a high-IQ tend to carry extra mutual funds and larger variety of stocks. Therefore, profit more from diversification results. “95 https://1investing.in/% of all merchants fail” is the most generally used trading related statistic across the internet.

If you wish to take an lively position in your investing, it’s entirely potential to constantly beat the market by investing in high-high quality stocks. The greatest lengthy-term investments have strong histories of profitability, growing dividends, and glorious management, simply to call a few qualities.

You can’t begin with 10K and hope to make a living. You can’t even purchase a single lot of some shares (AMZN for instance) and considerably much less pricier ones would possibly take most of your capital to make a single commerce.

Stock Trading Vs. Investing: What’s The Difference?

Well, at $20 per round-journey commerce ($10 each after they buy and promote) and roughly 250 buying and selling days per 12 months, this adds as much as a staggering $a hundred and fifty,000 in commissions over the course of a yr. In different phrases, you would want to earn trading income of $150,000 simply to interrupt even.

Practiced at taking money, the professional is coming after your orders if he/she thinks he came make a revenue on it. Know how you will handle every single state of affairs which can arise, and have a plan for it. Without this type of preparation, you are a sitting duck and can be a part of the roughly 96% of unsuccessful males, and about 60% of unsuccessful girls day merchants.

Training was mostly order sorts, market basics, and software related. Therefore the coaching could be just like what most individuals would get from a excessive-degree introduction to the stock/foreign exchange market course. Working from house as a day trader you are able to do what you need; nobody is around to inform you in a different way. Eat breakfast and mentally prepare yourself for the day.

How Much Trading Capital Do Forex Traders Need?

How can I turn $100 into $200?

No Pattern Day Trading Requirements Most international markets do not have the pattern day trading requirement. With the pattern day trading requirement out of the way, you could start with anywhere from $5,000 to $20,000.

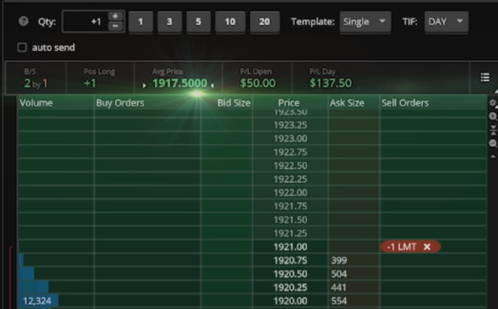

Such orders allow the lively trader to buy and promote with out having to observe the worth https://cex.io/ each second of the day. They set their orders and know that if the worth reaches those levels their orders will trigger.